Welcome

PULPS Loan Pricing System

We provide banks with a competitive advantage through better pricing of their commercial loans. Increase your profitability on your commercial loan portfolio by optimizing your loan rates and terms. For example, if you add 1 basis point to a 100 million dollar loan portfolio you gain $10,000 PER YEAR in profit!

Additionally, regulators are looking for Banks to show profit in loan pricing and a reproducible consistent methodology.

Ask for a FREE trial account to test the PULPS online loan pricing model or start with an online live demo.

Please contact Alan Lee to discuss your needs. We look forward to speaking with you.

Sign up for a FREE Demo here:

Videos

Video #1 Introduction to PULPS, 2 minutes

Video #2, How Banks set loan prices today, 2 minutes

Video #3, Full demo and intro training

Overview of PULPS and PULPS PLATINUM

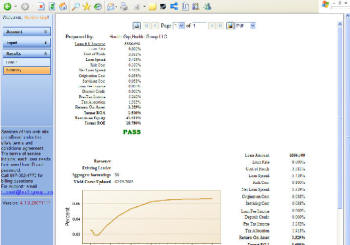

How it works: PULPS™ and PULPS PLATINUM™ are dynamic commercial loan pricing models designed to incorporate all the essential analytics required to determine if the pricing on a given commercial loan meets the profit objectives of the financial institutio...

National Loan Origination Cost Report

How it works: Commercial loan origination costs and servicing costs continually change. Hurdle Group surveys banks in the United states to create the National Loan Origination Cost Report on a Quarterly basis When your organization funds a commercial lo...

Get a free demo

Just use the form above to request more info or a demo by Phill Rowley. Phill has taught commercial loan pricing for over 30 years at the top banking schools.